资源类上市公司债务融资的治理效应研究

资源类上市公司债务融资的治理效应研究(含选题审批表,任务书,开题报告,中期检查报告,毕业论文17800字)

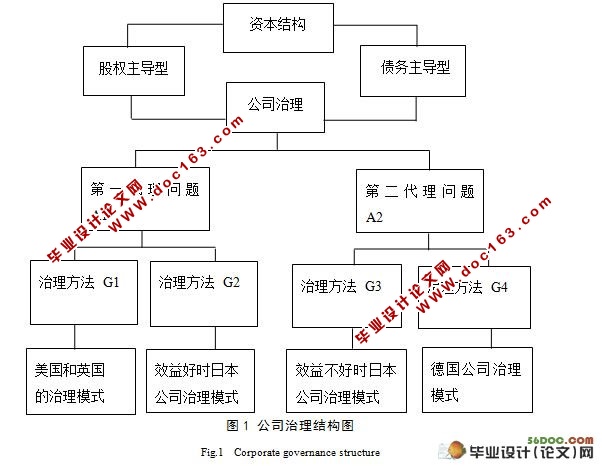

摘 要:本文主要研究资源类上市公司债务融资的治理效应,以求对完善资源类上市公司治理方法、促进中国资本市场健康发展有所启示。本文大体采用规范研究与实证研究相结合的方法进行展开。首先是国内外债务融资治理效应理论研究的借鉴,其次是对资源类上市公司的现状进行研究,再次是对资源类上市公司的资本结构、债务融资状况进行分析,最后从266家资源类上市公司中随机选出40个样本量,采用多元线性回归进行实证研究。得出资源类上市公司债务融资治理效果不明显的结论,分析出现这种结果的原因并提出对策。

关键词:资源类上市公司;债务融资;公司治理;治理效应

The Research of Debt Financing Effect on corporate Governance in Listed Company of Resources

Abstract: This article main research resources class to be listed debt financing government effect, governs the method to the perfect resources class to be listed, to promote the China capital market healthy development in order to have the enlightenment. This article uses the method which the standard research and the empirical study unify to carry on roughly launches. First is domestic and foreign debt financing government effect fundamental research model, next is conducts the research to the resources class to be listed' present situation, is once more to the resources class to be listed capital structure, the debt financing condition carries on the analysis, finally selects 40 sample sizes stochastically from 266 resources class To be listed, uses the multi-dimensional linear regression to conduct the empirical study. Draws the resources class to be listed debt financing government effect not obvious conclusion, the analysis presents this result the reason and proposes the countermeasure. [资料来源:Doc163.com]

Keywords: Resources listed company; Debt financing; Corporate governance; Management effect

[来源:http://www.doc163.com]